Financial accounting is an important field of accounting. This field of study deals with analysis, summary, and reporting financial transactions of a company. If we talk about the financial accounting assignment help in Australia services, they assist scholars in resolving issues faced with financial accounting assignments. At this service, students come to interact with subject-matter experts who have been into assignment help from at least 5 years.

The experts offering financial accounting assignment help in Australia have covered assignments related to Accounting Theory, Process of Financial Accounting, Financial Accounting Introduction, BAIBF08002, ACD10403, ACCT6003, etc. Moreover, they possess ample knowledge about recording transactions, preparing balance sheet, financial statement, cash flow statement, income statement, and more. Thus, taking help from financial accounting assignment experts can be the best option for students seeking help in financial accounting projects.

Our financial accounting assignment service experts define it as a broad spectrum that is vast and complicated. There are mainly two branches of financial accounting i.e.

These two methods are distinct but they follow the same concept of double-entry accounting to note, examine, and report financial transaction entries for a specific period of time. More details about them are discussed below in detail by assignment help experts. Let's read it.

Cash accounting is also known as cash-basis accounting which is used to record payment receipts for the period they are received and expenses receipts for the dates they are paid. Our financial accounting assignment experts explain it as "expenses and revenues are recorded when cash is paid or received". This financial accounting method is mostly used by small businesses because it is straightforward and simple. It also gives clear information about the total in-hand capital a business has. Let's understand this with an example –

If an organisation named XYZ gets an order to deliver 20 computers on November 20, but computers were delivered in the month of December, then the sale will be reflected in the month of December only instead of November.

The XYZ organisation receives 2000$ against the sale of 20 computers from company LMN on December 20. Being an accounting student, you may know that the sale transaction will be recorded for December 20, not for November 20.

Our experts providing help in financial accounting assignments say that the firms generally record income for the date when it receives and expenses for the date they are paid.

The second branch of financial accounting is accrual accounting. This accounting method generally examines and evaluates the position and performance of a company. In other words, the accrual accounting method is where expenses and revenues are recorded when transactions are made rather than when it is paid as we do in cash accounting. The basic accrual accounting concept is to recognise economics events by the matching principle at the time of making transactions.

Students seeking more details about the financial accounting branches can avail financial accounting assignment services. Here, a team of an accounting professional is available to assist in every possible manner.

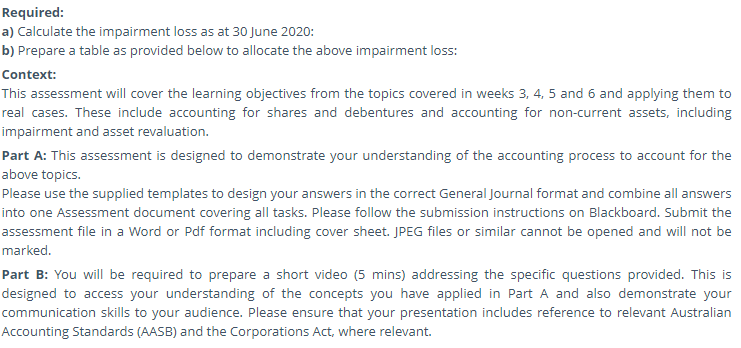

In this section, our experts providing accounting assignment help in australia have explained the ACCT6003 assessment. It is an individual assessment. The questions asked in the assessment require the skills and knowledge to calculate profit & loss, shares, debentures, accounting procedures etc. Let's have a look at the assignment requirements:

In the above snippet, you are asked to deal with two things i.e. calculating impairment loss for the given date and include a table to allocate this loss. As per our financial accounting assignment services' experts, in part 1, you must identify the loss and prepare a table to allocate them whereas, in part 2, you must present a video addressing all the questions. They also added that student's assessment will be done based on their technical understanding and presentation skills. Thus, it becomes important to complete the task effectively and clearly.

In case, if any type of issue is found, feel free to contact accounting experts offering Financial accounting assignment help in Australia. They will help you with each part of the assessment and guide in writing the assessment.

When we talk about the businesses dealing in selling widgets, cleaning services, or manufacturing equipment, they run on the modern financial accounting principles. In the book of accounting, there are five accounting principles such as revenue principle, expense principle, matching principle, cost principle, and objectivity principle. These accounting principles are described below by our experts providing financial accounting assignment help in Australia.

Revenue principle deals with the recording of transactions as revenue in the books of account. This principle states, the business's revenue is received and recorded at the time of sale which means that the revenues are documented when they are earned, no matter when payment is received.

This accounting principle states that the expenses to be accepted in the same period when they have occurred. If this is not the case then expenses should be accepted as incurred that predate the time when revenue was recognised.

The matching principle helps in reporting expenses on the statement of income in the period when revenues are received. Additionally, it occurs as a liability that appears in the balance sheet. This accounting principle is concerned with adjusting entries and accrual accounting.

The cost principle is also called the Historical Cost Principle, which is required to record assets in cash or its equivalent. Moreover, the recorded amount will not be greater than before for improvements or inflation in market value.

The objectivity principle deals with the financial statements that depend on solid evidence. The aim of this principle is to keep the accounting and management department of a body from generating a financial statement.

So, these were the major accounting principles discussed by our financial accounting assignment help experts. Moreover, our experts provide knowledge about ratio analysis, dividend models, capital budgeting analysis, etc. Thus, if you need help in financial accounting assignments, place your order now!

If you are seeking for the top financial accounting assignment help in Australia then you have reached to a correct destination. At Online Assignment Expert, you will get world-class assignment help at pocket-friendly prices. In addition to this, you will also be assured of the following:

Willing to book your order with us? Click on ORDER NOW and fill the asked details. Once your details are received, our financial accounting assignment help experts will contact you.

Get 24x7 instant assistance whenever you need.

Get affordable prices for your every assignment.

Assure you to deliver the assignment before the deadline

Get Plagiarism and AI content free Assignment

Get direct communication with experts immediately.

Secure Your Assignments

Just $10

Pay the rest on delivery*

Looking for expert guidance with your academic tasks and still searching for clear answers? Your quest ends here - explore our FAQs below!

Financial accounting involves recording, summarizing, and reporting a company’s financial transactions. It’s essential for preparing financial statements like balance sheets, income statements, and cash flow statements. Understanding these concepts is crucial for completing assignments accurately and effectively.

You can get professional assistance through services like Online Assignment Expert, which offers financial accounting assignment help in Australia. Experts provide guidance, help with problem-solving, and deliver solutions that meet academic standards.

Yes, reliable assignment help providers ensure that all solutions are 100% original. Each assignment is crafted from scratch according to the student’s requirements, using plagiarism detection tools to maintain academic integrity.

Common topics include financial statements, accounting principles, cash accounting, accrual accounting, ratio analysis, and capital budgeting. Assignments may also cover case studies, company analysis, and problem-solving based on real-world financial scenarios.

Yes, many services offer urgent financial accounting assignment help online. Experienced experts can deliver high-quality assignments within tight deadlines without compromising accuracy or quality.

To maximize grades, choose experts with relevant qualifications and experience. Provide clear instructions, communicate regularly with the expert, and review the work before submission. Using trusted services like Online Assignment Expert ensures that your assignments are both accurate and professionally presented.

It's Time To Find The Right Expert to Prepare Your Assignment!

Do not let assignment submission deadlines stress you out. Explore our professional assignment writing services with competitive rates today!

Secure Your Assignment!