Studying revenue law courses in Australia will help you understand the intricacies of taxation and revenue system of Australia as well as other countries. Also, it develops knowledge, skills, and abilities to examine, understand, analyse, and solve complexities of the subject as well as real-life examples in the area of commerce and finance. The Australian taxation system is complicated to understand for a lot of students. It comprises over 125 taxes including Commonwealth taxes like Capital Gains, Income Tax, Goods & Service Tax, Fringe Benefits Tax, and more. Having knowledge about Commonwealth taxes can be the most difficult task for students, due to which they are unable to write their assignments. In this situation, we are here to support them through our revenue law assignment help.

As a student, you must know the Australian taxation system, types of taxes, where are the powers to tax, principles of Goods Tax, Government taxation reviews, etc. The assignments covered under the study of revenue law are mostly based on the above points. Thus, it becomes important to know about these concepts. And if challenges still occur, then you can avail revenue law assignment help to complete your papers. Let's read the essential information about revenue law. Hopefully, it will help you with your assignment.

In Australia, there are mainly three types of taxes such as the proportional tax, the regressive tax, and the progressive tax. Students willing to write their assignments on their own must have complete knowledge and understanding of these taxes. Our revenue law assignment experts have described the types of taxes below;

Proportional Tax: The proportional tax levies the same taxation percentage to everyone, irrespective of their income. Thus, if the tax rate percentage is uniform, then the rate of average tax will be also constant, despite income. It means if your income is increased, the tax percentage will remain the same.

Regressive Tax: This form of tax carries out a high taxation rate on low incomes as compared to high incomes. Our experts providing revenue law assignment services have made it clear with an example, suppose, the state sales tax is 3%, the person having a lower income is required to pay a high percentage of their income in sales tax.

Progressive Tax: The progressive tax enforces a high rate of taxation percentage in terms of high incomes. This tax works on a marginal tax rate which depends on the taxable income amount. Hence, the tax percentage of income increases when the income is increased.

If you want to know more about the taxes covered in Australia, feel free to avail our revenue law assignment help service. Your queries will be solved with the correct solution offered by subject-matter experts.

In order to assist in evaluating the change in tax rules, the American Institute of Certified Public Accountants has developed a structure including few elements of a good tax policy such as Equity, Efficient, Simplicity, and Neutrality. Our revenue law assignment experts have discussed them in detail.

Equity: It includes vertical equity as well as horizontal equity. Here, horizontal equity refers to taxpayers who have equal ability to pay taxes in the same position should pay the same amount of taxes whereas vertical equity explains that the taxpayers with a higher ability to pay taxes should pay higher taxes in a different position.

Efficient: This form of tax does not tilt the decision of resource allocation toward the economy, contributing to a productive and strong economy. It includes two important elements i.e. administrative efficiency and economic efficiency.

Simplicity: The rules for taxes should be made in a way that it should be easy to understand and comply at the lowest cost. It helps reduce errors and enhance respect for the results and system in enhanced compliance. These systems also make the taxpayers understand the significance and values of planned and actual transactions.

Neutrality: It is a principle where the effect of taxes should not stimulate the choices of taxpayers by changing the costs of substitute goods or artificially distorting various investment modes or activities.

Government Revenues: The Australian Government can determine the timing and amount of the revenue produced from the tax system. This system has a level of reliability and predictability.

If you are still in need of help in revenue law assignments, then Online Assignment Expert can be the perfect solution. Here you will interact with a team of professional assignment writers delivering 24*7 academic help to students pursuing taxation or revenue law courses in Australia.

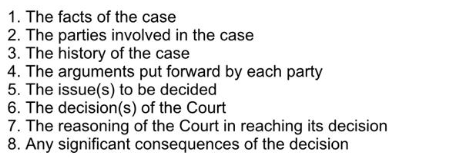

Under the study of revenue law, you undergo various topics such as 76016 Advanced Revenue Law, primary sources of revenue law, internal revenue law, tax law cases, etc. Our revenue law assignment experts have detailed knowledge of these topics that's why they can write assignments easily. Recently, they have worked on a topic known as "LAWS 13014". This law assessment was offered by Central Queensland University. Under this assessment, students were asked to address the following:

We understand that answering the above tasks can be troublesome for many students and thus our revenue law assignment experts have explained the right approaches. They are -

If you want to know more about the revenue law or its assignments, then read the information given below by our law assignment help experts.

The experts who provide revenue assignment writing services possess a Masters degree in Revenue Law from universities in Australia. In addition to this, they have vast knowledge of the various segments of revenue law. They have explained the key types of revenue law assignments written by themselves recently:

Operating Revenue Law: It is a type of revenue that business achieves through its normal operations such as commission, sales, and other things. Importantly, this revenue only reflects normal revenue rather than one-time revenue. To determine the operating profit, operating expense is subtracted from operating revenue. Thus, it becomes important for students to know the process to determine operating profit and other details that are important in writing assignments.

Non-operating revenue Law: This revenue is seen as that gained from the other side activities rather than ordinary operations of the business. This revenue is also termed as peripheral or incidental revenue. The best example can be interest income or investment income of a retailer. If you find difficulties to deal with the non-operating revenue topics, you can avail our revenue law assignment help where exact solutions are offered to a particular concern.

Sales revenue: Sales revenue can be explained as the amount collected by the sale of goods and services of a business. Such a figure is used to determine business size. The concept is divided into two variations i.e. Gross Sales Revenue and Net Sales Revenue. Students enrolled in revenue law courses from an Australian college and willing to write assignments on their own must have adequate knowledge of the two variants of sales revenue and how to calculate them.

Rent revenue: Rent revenue is gathered from the business by providing their business equipment or buildings on lease or rent. Rent revenue comes under accrual accounting. In a few countries, it is known as rental income. While preparing a balance sheet for business, rent revenue is kept under the income statement. It means the law courses students must have knowledge of how to prepare a balance sheet, rent receivable, rent payable, accrued rent, etc.

If you are a student and searching for expert's help in revenue law assignment, then Online Assignment Help Expert is the best choice for you. We have been offering revenue law assignment services in Australia since 2010 and have assisted thousands of students in terms of research, writing, editing, proofreading, quality check, and plagiarism check. By hiring our expert, you will be assured of the following:

Stop thinking and hire our experts now to enjoy exciting discounts & offers.

Get 24x7 instant assistance whenever you need.

Get affordable prices for your every assignment.

Assure you to deliver the assignment before the deadline

Get Plagiarism and AI content free Assignment

Get direct communication with experts immediately.

Secure Your Assignments

Just $10

Pay the rest on delivery*

It's Time To Find The Right Expert to Prepare Your Assignment!

Do not let assignment submission deadlines stress you out. Explore our professional assignment writing services with competitive rates today!

Secure Your Assignment!