Managerial accounting is also known as cost accounting. It emphasises on the information received through financial accounting. The reports based on managerial accounting are generally used for planning, organising, decision-making, regulating and measuring the performance. Such reports are being prepared all over the bookkeeping and accounting period as per the requirement.

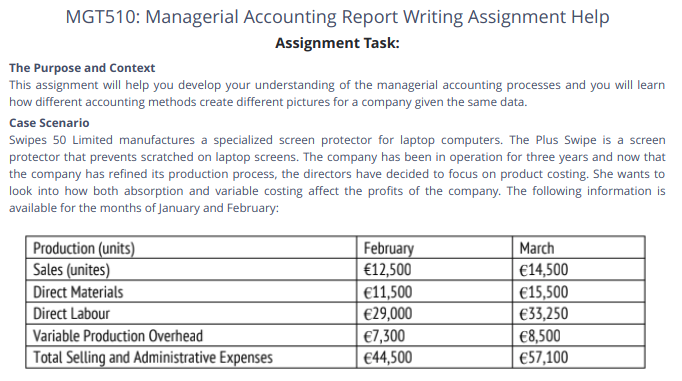

However, a sample has been attached below:

Additional Information:

The aim of writing the above MGT510 assessment answer is to develop an understanding of managerial accounting processes. You will come to learn the various ways to create pictures of an organisation through accounting methods.

Approach To Be Followed For MGT510: Managerial Accounting Report Writing Assessment

To write the MGT510 Managerial Accounting Report Writing Assessment answer, simply follow the below-given methods:

Step 1: Read the given case scenario completely to understand the requirement.

Step 2: Identify the key components of managerial accounting such as identifying, analysing, measuring, interpreting and communicating.

Step 3: Review and evaluate the practices leading to managerial accounting processes.

Step 4: Explain the importance of variable costing and absorption costing.

Step 6: You must propose ideas through which Swipes 50 Ltd can improve its accounting system. As per the accounting assignment experts, the writers must have the knowledge of accounting standards so that they can identify and analyse which standard to be used.

Business owners, managers, and shareholders need managerial accounting reports to get help in the decision-making of a business. The accounting staff is required to make income statements, cash flow statement and balance sheets. Moreover, managers require reports like forecasts, budgets and comparison reports to find out about the business position.

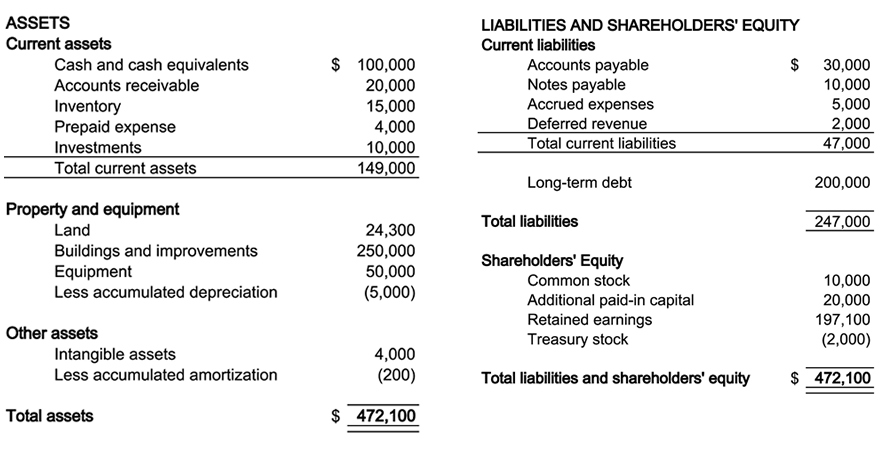

Preparing a Balance Sheet

Creating a balance sheet requires knowledge of the standard accounting equation. The formula is Assets = Liabilities + shareholder’s equity. If the writer is using standard accounting software, they can be able to print the balance sheet for a particular period of time.

There are two columns under the balance sheet, i.e., assets and liability. Assets are written on the left side whereas liabilities go on the right. Underneath assets, including cash, fixed assets, accounts receivable, inventories, etc. And on the other hand, liabilities include accounts payable, note payable, deferred revenue and share holder’s equity.

Creating an Income Statement

The income statement is also prepared as a balance sheet at a regular accounting period. The income statement of a company reports the expenses incurred and the number of profits for a particular period. You can begin with :

Maintaining Cash Flow Statement

The cash flow statement is a financial statement which summarises the cash and cash equivalents of a company. The CFS is used to measure the cash positions, generate cash to pay operating expenses and debts.

How to calculate the cash flow statements?

Begin with the current cash balance and add the cash expected to receive within the given time period. This cash could be received from loan proceeds, customers or investors.

After this, subtract the expected cash outflows.

In short, here’s the formula:

Ending cash = Beginning cash + projected inflows – projected outflows

If you are a student and have received the MGT510 Managerial Accounting Report Writing Assessment to write, you can follow the steps given above or simply get in touch with accounting assignment experts. They will provide a well-drafted report for your order. So, hurry up and avail affordable assignment help by our team as limited-period discounts are currently live!

Get

500 Words Free

on your assignment today