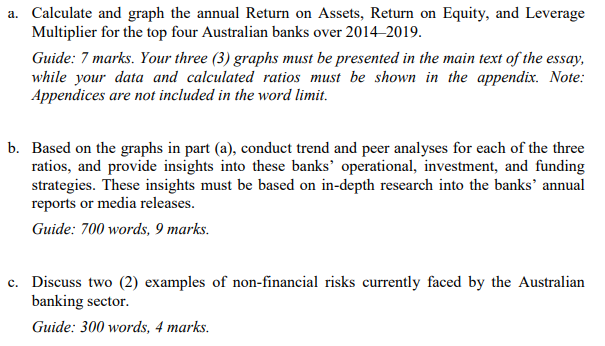

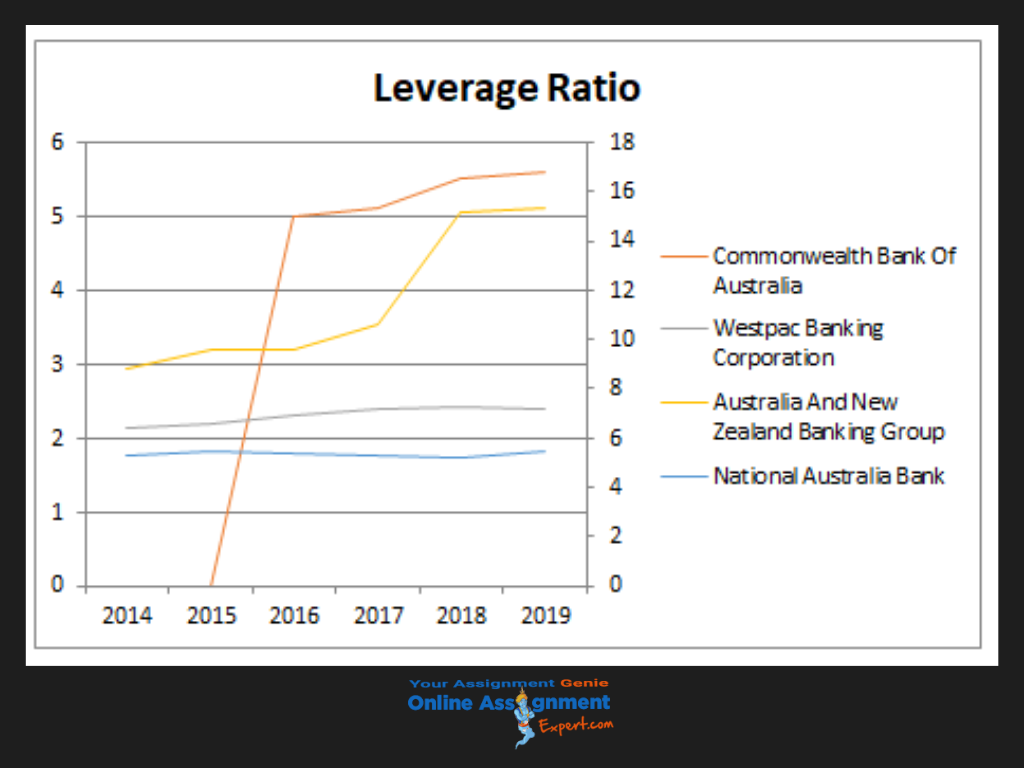

The above questions clearly state that you are required to make a graph and calculate the annual return assets, equity returns, leverage multiplier. After this, conduct the trend and analyse each ratio, depending on the graphs you have prepared. In the end, you are required to explain the two examples of non-financial risks currently facing by the banking sector of Australia.

The above questions clearly state that you are required to make a graph and calculate the annual return assets, equity returns, leverage multiplier. After this, conduct the trend and analyse each ratio, depending on the graphs you have prepared. In the end, you are required to explain the two examples of non-financial risks currently facing by the banking sector of Australia.

Apart from these graphs, you are required to explain a few different terms such as non-financial risks and Trend and Peer Analysis. If you are a student who is finding issues in writing the best piece of the BFF2401 Commercial Banking and Finance assessment, the answer can refer to the assignment structure given below.

Apart from these graphs, you are required to explain a few different terms such as non-financial risks and Trend and Peer Analysis. If you are a student who is finding issues in writing the best piece of the BFF2401 Commercial Banking and Finance assessment, the answer can refer to the assignment structure given below.

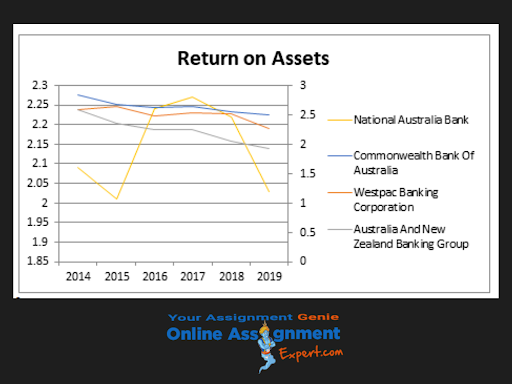

Trend & Peer Analysis

In this section, you are required to deal with the relative performance of the given four Australian banks.

Trend & Peer Analysis

In this section, you are required to deal with the relative performance of the given four Australian banks.

Non-Financial Risks

Here, you are firstly required to describe the term "Non-financial risk" affecting the participants. A few of the non-financial risks are:

Non-Financial Risks

Here, you are firstly required to describe the term "Non-financial risk" affecting the participants. A few of the non-financial risks are:

Get

500 Words Free

on your assignment today