In today’s blog, we are going to discuss how to write the FNS40815 Certificate IV assignment answers. This assignment is mostly asked by students to write who are studying at Kaplan Business School of Australia. Under this course, students learn about preparing and presenting loan applications, strategies about proposing broking options to customers, how to manage legislative effectively and code of practice obligations. However, let us read further details.

This assignment wants to answer a few questions that you can find below on the same page. You should either write or type the answer into a different document stating your name and exercise 4. In a few cases, you will be given references to such units where you will find relevant information whereas in some cases you need to present your understanding of the subject or take help from the internet. The assessor will also look for your literacy and numeracy skills as well. Therefore, make sure that your assignment is:

Below, you will find the questions that are a part of the FNS40815 Certificate IV in Finance and Mortgage assessment. In the last few months, hundreds of students have inquired about the FNS40815 assignment solutions on WhatsApp. If you too are facing issues in writing answers to any of the questions, then do not hesitate to chat with our experts.

Approach 1: Start with Executive summary

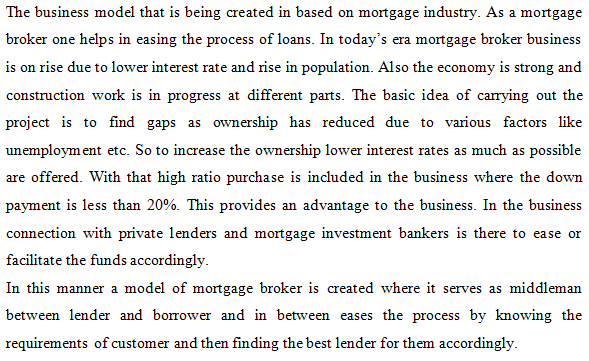

In the FNS40815 Certificate IV assignment, the first section you should write is the executive summary. Here, you must explain the background of the product, service, or an organisation whichever you have selected. Here’s a FNS40815 Certificate IV in Finance and Mortgage assessment answer sample:

Approach 2: Situation Analysis

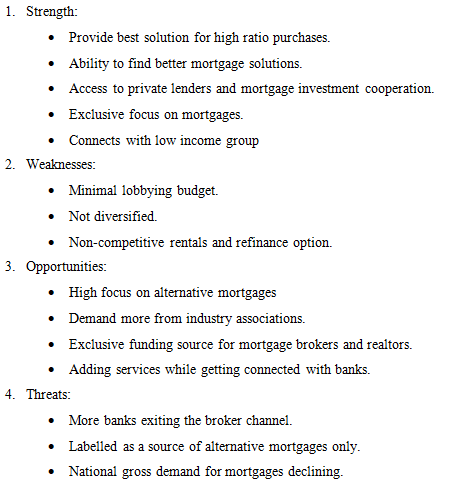

There are different methods to analyse the situation of a company or firm. In this assessment, our finance assignment experts have conducted SWOT and PEST analysis methods to analyse the situation. SWOT includes explaining Strengths, Weaknesses, Opportunities, and Threats whereas PEST involves Political, Economic, Social, and Technological aspects.

Approach 3: Competitive Analysis

Here, you must explain the terms like demand for service, competitors, weaknesses, and strength of your competitor, examine the marketplace competition. If you do not have knowledge about such terms, you might need help from subject-matter experts who are well-versed with the knowledge of finance and mortgage.

Approach 4: Marketing Goals

An organisation or a business set their future vision on the basis of market analysis and strength and weakness. Being an assignment writer, you should identify the expected conversion rate, growth of business in the last one year, number of clients, rate of increase in sales, number of staff, profit earned, new services to be introduced, etc.

To get a better idea of the marketing goals, you can request us for the FNS40815 Certificate IV in Finance and Mortgage Broking assessment samples. Just drop your query in the form available on our website and our customer care team will get back to you in the shortest time!

Approach 5: Market Segmentation

Market segmentation is a process to separate potential customers into segments or groups on the basis of different characteristics. In the same way, while writing this assignment, you can categorise your clients as first time buyers, refinance candidates, investors, real estate agents, jumbo-loan lenders, etc. Moreover, you will also be focused on the targeted market, consumer research, consumer behaviour, evaluation, plan implementation, and others.

If you are finding any sort of issues while answering these questions, then simply contact our experts and avail the best assignment help services in Australia. Students have found our assignment samples useful as the experts always prepare them keeping in mind the instructions and requirements. To find out more, visit our website - Online Assignment Expert.

Get

500 Words Free

on your assignment today