If you are unable to understand the questions or case study in your real estate assignments, then it clearly shows you need an expert’s assistance. Our real estate finance assignment help can guide you in completing your finance assignments. We provide high-quality solutions to finance assignments so that scholars can score their desired grades in this subject. Our academic services are budget-friendly and the experts will prepare your assignments exactly according to the marking rubric. Just fill the form, mention the details and we will get back to you in the quickest time.

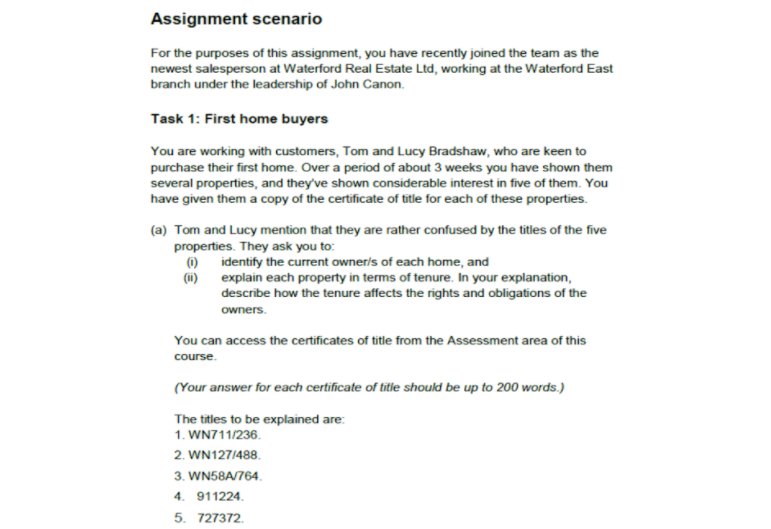

“Real estate financing” is a technique used by stockholders for securing their funds while making a deal or providing a loan. This can be either related to securing capital or renovating a property. Scholars choosing real estate finance as a career need to gain confidence, reliability, and familiarity with the standards and laws of the local market. Finance is one of the trickiest subjects as it majorly deals with the numeric part of the studies, because of which the students have to undertake real estate finance assignment help from finance experts.

We can define “real-estate finance” as loaning or borrowing. In other words, it is an investment for those who opt for a loan, and for those who provide these financial loans, it is a liability. There is a huge risk associated with the two scenarios. Therefore, a scholar needs to understand the concepts efficiently for avoiding any financial problem in their future job. Professors flood scholars with finance assignments to improve their learning process and knowledge. You must not get confused with real estate financing and personal finance. Both are different concepts.

However, many students work part-time to earn money and are not able to complete their bulky assignments. Thus, they take guidance from the finance academic writers at Online Assignment Expert. We have more than 10 years in completing finance assignments for scholars. Some of the major features of real estate financing are as follows, can you add some more?

There are different sources by which financiers provide the funds for mortgages and loans. In your coursework, you will be studying the development of ideas & tactics for forming monetary bids of real estate. The financers utilize the sources available in the financial markets which can be characterized as:

This finance foundation comprises equity wealth, preference stocks, reserved returns, and bonds. Equity capital is defined as the share of the unit value of an organization. This is the most common “long-term” source of finance. Moreover, it has no fixed reimbursement requirements. Also, the businesses that utilize equity over debts have a lower hazard of bankruptcy.

These finance sources include loans for a shorter period. It can be of two types: trade credit and factoring. When an organization requires liquid cash, a short-term loan is the best option for them. This source can be opted for in case of emergencies, for example, while building a real estate hotel, company, etc. Trade credit helps an organization to buy goods, without immediate payment. It’s a “buy now pay later” finance source. Factoring can be termed as a "cash-strapped" business solution and is more expensive than a bank loan. Want to know more? Discuss your assessment tasks with our real estate finance assignment help experts.

Internal financial sources are generally generated within a business, whereas external sources are related to the suppliers and investors, that is, outside the business. Careful cost analysis before & after real estate finance can improve the viability. An organization can apply for loans from external sources also, which can be classified into two categories: shared capital & debt capital.

Corporate Finance deals with the finances of an organization which helps them to plan their future steps. It also guides an organization to achieve a competitive edge over its competitors. Corporate finance acts as a roadmap for the organization which directly or indirectly impacts the future decisions taken by the organization that can help to enhance the value to the shareholder. Scholars generally discuss these concepts with our experts to clear their basics about corporate financing.

As the name suggests, personal finance refers to the financial decisions that an individual takes to enhance his/her standard of living. Personal finance includes managing the financial condition of an individual or the individual’s family. It is commonly known as a “budget” because it comprises all the investments made or taxes paid by an individual. Personal finance helps an individual to identify the cost of living that they can afford so that they do not have to bear heavy losses and go into debt.

Public finance identifies the role of the central bank as well as the government of the country in managing the financial resources. It explains how they can be utilized for enhancing the economy of the country. Public finance plays a very significant role in providing solutions regarding the proper allocation of the resources as well as how the income should be distributed through the country. This is important for bridging the gap between the poor and the rich and for entitling the poor people with the essential resources for survival. This is an advanced course, therefore, scholars seek help from our experts.

Get 24x7 instant assistance whenever you need.

Get affordable prices for your every assignment.

Assure you to deliver the assignment before the deadline

Get Plagiarism and AI content free Assignment

Get direct communication with experts immediately.

Secure Your Assignments

Just $10

Pay the rest on delivery*

It's Time To Find The Right Expert to Prepare Your Assignment!

Do not let assignment submission deadlines stress you out. Explore our professional assignment writing services with competitive rates today!

Secure Your Assignment!