For the above question, Personal Loans can be the best option to make your academic life more comfortable financially. If you are studying in Australia and looking to get a personal loan, you can opt for a student loan system known as the Higher Education Loan Program (HELP). With the help of this system, eligible students can pay off their necessary expenses.

There are three different sources to get a personal loan in Australia. They are –

Unfortunately, international students cannot get a loan from government banks but do not worry because you can secure your personal loan with private banks and universities. Let us read the following details such as eligibility, types of loans, etc. explained by the experts providing finance assignment help in Australia.

Getting a personal loan from an Australian private bank cannot be easy as it requires the following things:

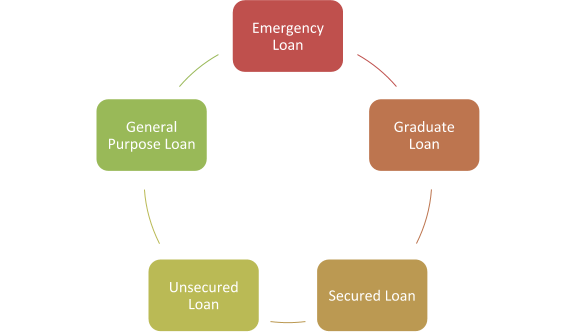

Willing to know what are the loan types available for international students in Australia? Your wait comes to an end.

Emergency loan is mostly offered by the institutions. This loan is helpful for university scholars who suddenly run out of money. You do not need to pay any amount of interest and do not require collateral. You can repay the loan within the given time frame. The amount of loan is up to $1,500.

A student pursuing a bachelor’s degree from an Australian university and need a loan can freely apply for Graduate Loan. But remember you must be in the final year of your graduation to take advantage of this loan. As per the best finance assignment help professionals, you can repay the loan amount even after one year because you are free from the settlement of graduate loans for the first year.

The secured loan is a type of loan that is backed up with something valuable of a student which is known as collateral. The best examples are jewelry, vehicles, etc. If you are eligible for a secured loan, the lender will deed that collateral and if you failed to repay the loan amount, the collateral will be sold to recover the debt.

The name “unsecured loan” clearly states that this loan is unsecured. But how? Students do not require providing any sort of collateral to the bank against the loan. Happy? But the downside of an unsecured loan is that students need to pay a high-interest rate in exchange for this loan. The unsecured loan can be used for any purposes except illegal.

This loan is offered by both the private bank as well as the university. This loan can help you to cover your interest than education. For example; the cost of living, the money required to work, travel, etc. The universities offer the loan amount up to $8,000. If you want a higher amount, it is suggested to apply for a general-purpose loan from a bank.

Assignments are also important just like your personal loan. Borrowing a personal loan in Australia to meet the required expenses won’t be of use if you are unable to score better grades in your assessment. Thus, Online Assignment Expert is here to help you with incredible assignment help services where students are assisted in terms of writing, proofreading, editing, quality check, and plagiarism check. Moreover, you can ask for assignment samples to get ideas on how to write academic assignments.

For more details and the latest offers, stay tuned with us.

Get

500 Words Free

on your assignment today