Well, we already know that you are a finance student. Guess, how? Obviously, if that would not have been the case, then why would you land on this blog? Nearing the end of the semester has brought you here for searching some information on financial modeling, isn't it? Online Assignment Expert would be pleased to be your guide for this journey. As you would already know financial model is a well-defined system of mathematical equations and data. This model describes the relationship between financial and operating variables. So, are you ready? Our financial assignment help experts will take you round sensitive analysis, which is considered to be a vital aspect in financial modelling.

Basically, sensitivity analysis depicts how interdependent variables impact dependent variables. This is performed with the help of a feature known as data table present in excel. So, our finance assignment help experts have guided thousands of students like you on solving problems concerning sensitivity analysis. To let you known our experts approach these assignments, below enclosed is a Financial Modelling AC6005E assessment sample which we have completed recently, when a student came to us with his query.

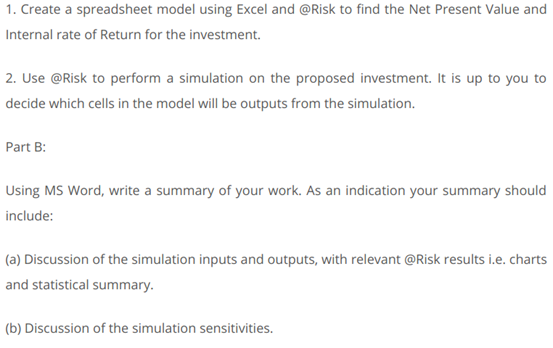

Our experts wrote a reference assignment for the student in which they progressed on an assumption. However, we have delivered the complete reference assignment to the student, right at his doorsteps, we would only be discussing a brief way of approaching which would be effective enough to impart the fundamental skills in you related to the topic. For the complete solution of this file or any other such file, you can easily get in touch with our financial assignment help experts via the order now form. So, in this assignment our AC6005E assignment experts assumed to a company named ABC. Then, we created a spreadsheet model of the data of the organisation given in the question file. Firstly, we calculated the gross profit. Then, using a variable named @Risk, we found out the net present value and the internal rate of return for that investment. Thereon, we judged the sensitivity of the Risk-return based on the other two variables. For a table of two-variables, we copied the actual formula of @Risk at the intersection of row and column values. In the end, with the help of sensitivity analysis we finally are able to judge the impact of independent variable on dependent variable.

According to our financial assignment help expert, a financial model can never be static. This is because there is always an element of dynamism connected to these models. Sensitivity analysis helps you to draw insight on various dynamic scenarios. This is where our financial modelling experts step in and help you draw out the insights of these scenarios and bring improvement to your financial models. Whether you're working on a financial management assignment or building real-world models, our experts ensure accuracy and clarity.

Obviously, you cannot predict future right? Thus, being credible about the financial decisions would enhance the output of the financial model used. This is where sensitivity analysis helps you make confident about your decision.

Sensibility analysis opens new doors for a range of outputs and thus, provides more flexibility to the various financial models used in finance.

When you efficiently analyse how one variable is dependent on the other, you would automatically be able to assess the risk which is involved in that financial model. Based on this, you would be able to easily mitigate the risks involved in the financial decisions.

Guiding you on sensitive analysis, our finance assignment help experts assist you in making informed choices. By referring to a finance assignment sample, you can better understand how to analyze the level of responsiveness of the output in relation to the variables.

Although, there is a wide range of financial models which you might have come across in your universities, however, according to our Financial Modelling AC6005E experts, there are 10 most common and mostly used financial models which are used in corporate finance. These are:

If you have any doubts in any of these financial models, then you can easily contact us. Our steadfast crew of finance assignment help experts are all at your services!

Online Assignment Expert is a firm that works on the foundation of trust which students have showed upon us. We not just confine our duties to provide you expert guidance on various topics and subjects, but also hold you hands and help you reach that perfect grade which you have always desired for. The reference assignments and samples which we provide you are a fine blend of quality and hard work which our online assignment expert put in doing them for you. So, we are waiting for all your Financial Modelling AC6005E queries with open arms. So, what are you waiting for? Shoot!

Get

500 Words Free

on your assignment today